Innovation Unleashed

Subtle and more pronounced changes are sweeping the defence MRO sector. Mt looks at every facet of the enterprise, from expanding global networks to new technologies used in activities to evolving business models, which are improving the way weapons platforms, weapon systems and other materiel are restored to operational readiness.

The military-industry MRO team has received the message loud and clear from defence headquarters. In an era when huge quantities of materiel are being refurbished after more than a dozen years of combat in Iraq, Afghanistan and adjacent theatres of operation, and acquisition budgets remain constrained, the MRO part of a life cycle cost must be stabilised and preferably reduced. Senior military leaders expect their ships, aircraft, vehicles and other materiel to be returned to operational readiness quicker and cheaper.

Increased Platform Availability

Original equipment manufacturers are developing strategies to address MRO through their products’ life cycle. In a development certain to resonate with military operators and defence headquarter budget officials alike, the quest for MRO efficiencies is increasingly focused on reducing demand for these activities – in part, through increasing system and subcomponent reliability.

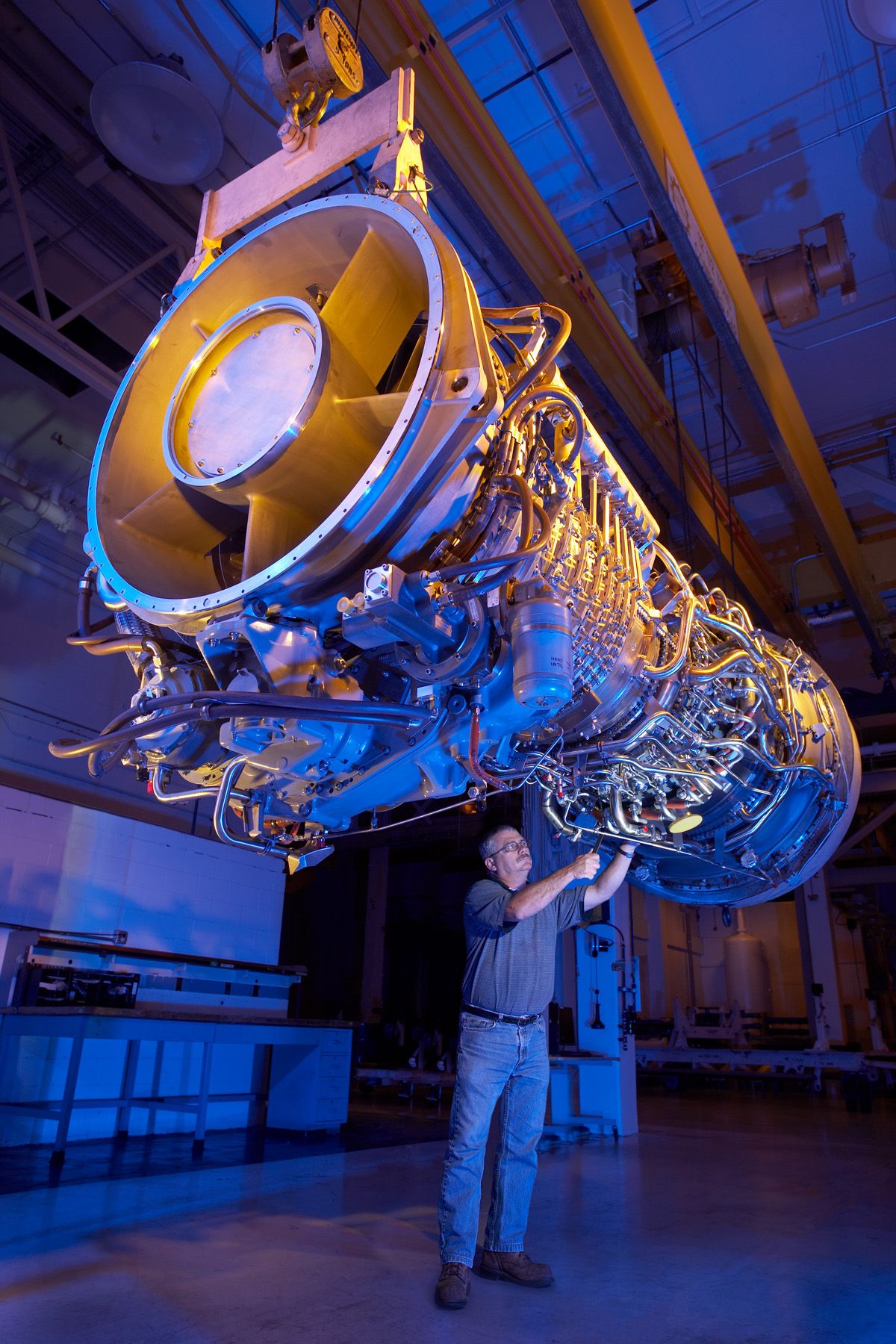

Dan Rampton, the Senior Services Staff Manager at GE’s Marine Solutions, offered that his company follows an “on condition” maintenance philosophy: “This means that engine overhaul is not time-limited, but arranged when necessary as revealed during a regularly scheduled inspection. Even while operating at full power, 100% of the time, combustor and hot section repair intervals can stretch beyond 25,000 hours when burning natural gas.”

GE’s maintenance philosophy, combined with very high reliability and a compact, easy-to- remove design, is reportedly yielding increased ship availability. The maritime sector expert further pointed out when an engine overhaul is required the gas turbine is removed and replaced by a spare unit, usually within 24 hours. “The ship is quickly returned to military or revenue service. Overhaul of the removed asset is not performed in-place (onboard the ship), but under shop conditions at a land-based depot facility. This approach ensures the highest quality service for the gas turbine and highest availability for the ship, since full power is always available from the installed engines,” he added.

Focus on Easier Maintenance

Another trend throughout the defence sector finds materiel designed to be more easily repaired “on the deckplates” of a ship or in other operational settings.

In one instance, similar to jet engines for airplanes, gas turbines are easily maintained on a ship, with line mechanics not responsible for extensive maintenance activities.

Indeed, GE’s Rampton emphasised from his portfolio’s perspective, all shipboard preventive maintenance tasks can easily be accomplished by ship’s technical and maintenance staff with little or no training. “These tasks are limited to filter changes, checking fluid levels, and inspecting for proper operation,” he pointed out and continued, “and typical for GE gas turbines, the LM2500 requires less than 160 man hours per year for preventive maintenance. Similarly, the majority of the infrequent corrective maintenance tasks can be accomplished by ship technical and maintenance staff after completion of only moderate training.”

Polaris Defense is bringing to bear enhanced training, internet-based “reach back” and special tools to bolster its maintenance force’s effectiveness and efficiency, concurrent with the expansion of its product portfolio.

John Olson, PhD, the company’s Vice President and General Manager, noted it, “uses state-of the-art design, development, manufacturing, test, and sustainment tools, processes, systems, and processes from cradle to grave across the lifecycle so that reliability, quality, sustainability, and ease of maintenance are ‘designed and built in’ from the start – and done right.”

Once delivered, Polaris engages its operators, trainers, and maintainers via Polaris training courses using state-of-the-art training materials and methods that include virtual reality and online training. Olson continued, “We also provide extensive manuals that contain clear and simple instructions, graphics, and checklists that build on our best-in-class customer support. Course offerings cover a broad spectrum spanning from driver and operator training to escalating levels of mechanic training. Once we’ve trained these mechanics, they are equipped to handle the majority of the maintenance work our vehicles require.”

To further support them worldwide, Polaris uses web-based programmes to be sure they have the latest information; same as Polaris mechanics and dealers. The Polaris executive added: “All mechanics that have completed our vehicle training have access to this knowledge base and online problem solving tools, just as our dealer network does. It includes service bulletins, vehicle diagrams, parts, service and owners’ manuals – and all the information is real time. At the vehicle level, all our ultra-light vehicle platforms can be diagnosed with ‘digital wrench’, which is unique among off-road vehicles. It basically gives the mechanic advanced diagnostic capabilities to troubleshoot any issue, clear codes and isolate repairs. On-board vehicle diagnostic software provides enhanced control over the vehicle’s functions and components and is often used during maintenance.”

Global Reach

Polaris’ expanding list of new and follow-on orders for military vehicle from outside the US is being generated by Direct Commercial Sales and through US government FMS channels. Accordingly, Olson emphasised his company’s MRO strategy is focused on its customers around the globe: “We are committed to providing all our customers with responsive, agile, scalable and affordable sustainment support and this comes in many forms, depending on what best suits each customer.”

Training, overseas Polaris distributors and company field service representatives (FSRs) are several foundations of Polaris Defense’s MRO strategy for non-US customers.

While Polaris Defense is continuing to provide driver and maintenance training direct to US forces in and outside the US, the company is also continuing to train, in country, US allies that have purchased its vehicles.

Concurrently, Polaris FSRs are locally assigned for customer accessibility and interface, timely feedback, problem resolution, operator training, maintenance training, and facilitating immediate access to parts and spares. Each FSR is equipped and knowledgeable in the use of diagnostic tools and serves as a conduit to Polaris internal programme management, engineering, and technicians for problem resolution. The company official added, “FSRs also facilitate partnerships Polaris dealers and others agents, where appropriate, to enhance the level of provided customer service.”

GE’s strategy also focuses on global support for its burgeoning list of non-US customers and numbers of units delivered to them, providing comprehensive field and depot level repair services. Rampton further noted that through customised service agreements, for example, customers can mitigate maintenance risks, while helping to assure predictable costs for quality OEM service: “With a global installed base and service network, operators can be confident of exceptional OEM support wherever they sail. However, because our network is so extensive, it would be unfair [to mention one industry partner] since we cannot mention all of authorised service providers. Suffice it to say, we have deployable technical representatives and we are a leader in local cooperation for naval and commercial ship support including depots in the US, Italy, Korea, Japan, Spain, Australia/New Zealand, and India.”

Unique MRO Niche for RPAs

The increasing number of remotely piloted aircraft (RPA) around the globe offers their military customers reduced, but unique, MRO challenges. Chris Pehrson, the Vice President for Strategic Development at GA-ASI, explained from his company’s perspective, that unlike other major weapon systems, GA-ASI RPA systems don’t require periodic depot maintenance. He added: “Our aircraft are made of composites and don’t experience corrosion or metal fatigue like most other airframes. A Predator B/MQ-9 Reaper, Guardian, or Gray Eagle, or any RPA from the Predator-series family, could fly its entire service life without returning to the depot.”

Indeed, the industry expert further reported there are several MQ-1B PREDATOR aircraft that have flown nearly 30,000 hours and several MQ-9A REAPERs that have flown more than 20,000 hours without any depot level maintenance. What MRO organisations do need to be attentive to, are situational maintenance needs. “Occasionally, our aircraft require unscheduled depot level maintenance for unanticipated repairs. Examples of repairs requiring depot maintenance could include damage from a hard landing, a bird strike, or a lightning strike,” Pehrson added.

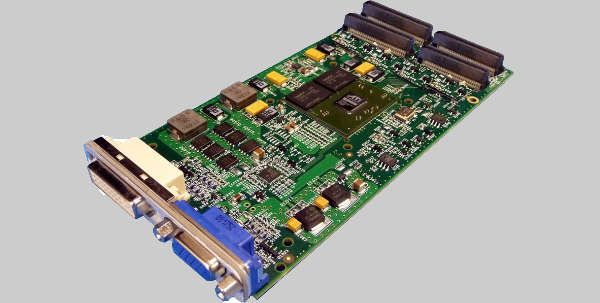

And while entire RPA systems may not require depot level maintenance, major components and sub-systems are returned to the depot for routine maintenance and overhauls. The industry expert further explained: “Engines and propulsion systems, propeller assemblies, sensors such as the MTS-B [Multi-Spectral Targeting System] or LYNX Multi-mode Radar, and Line Replaceable Units are examples of items that would undergo depot level maintenance on a regularly scheduled basis. Repairs may consist of a complete teardown, inspection and rebuild, or replacement of worn parts. All depot level maintenance procedures are performed in strict adherence to job guides and quality standards.”

Pehrson also lifted the veil on technologies used in the RPA MRO enterprise. In its case, GA-ASI is a vertically integrated company, which means that its manufacturing and production facilities perform functions from machining basic components and parts to full system integration. “Depot level repairs conducted at our company have the full range of tooling and machinery that supports our production line. This includes additive manufacturing (3-D printing), multi-axis Computer Numerically Controlled and milling machines, waterjet cutters, and other state-of-the-art manufacturing tools,” he said. “We also lay-up and build our own composite materials with cutting tools, forming tools, autoclaves, and other advance composite manufacturing capabilities.”

USAF KC-46 MRO Strategy

Among the new national programmes on Mönch’s watch list is the US Air Force’s effort to field 179 Boeing KC-46A tankers. As of this January 16, Boeing was on contract for the first two low-rate initial production lots, totaling 19 aircraft. Seattle-based Charles “Chick” Ramey, the Boeing programme spokesperson, noted: “Including work being done at our suppliers, we’ve got 20-plus aircraft in build at present. We currently have five aircraft in flight test.”

The KC-46 programme’s MRO strategy is concurrently and rapidly evolving.

The aircraft is a derivative of the Boeing 767 and is FAA (US Federal Aviation Administration) certified to that maximum extent possible, enabling the air force to operate and maintain in accordance with FAA equivalent processes and procedures, and utilise FAA certified parts. FAA continued airworthiness will be in accordance with 14 CFR (Code Federal Regulations) of Parts 121 and 145.

The maintenance concept for the KC-46 is being implemented in phases that has started with pre-operational support (POS), will transition to interim contractor support (ICS), and eventually transition to organic sustainment by the Air Force.

Allison Olson, a spokesperson in Global Services & Support Communications at Boeing, noted that during the POS and ICS phases Boeing is responsible for providing certified FAA spares and repairs, including aircraft depot heavy maintenance. Olson pointed out: “Boeing utilises Delta Tech Ops and Aviall for the majority of the supply chain services, and will also employ Delta Tech Ops for heavy maintenance visits while the USAF establishes organic capability. We are slated to deliver the first maintenance training device to McConnell Air Force Base and have it operational in 2018.”

Emerging Partnership

Last December 20, Rockwell Collins signed an agreement with Taqnia Aeronautics and subsidiaries to collaborate on military rotary and fixed wing avionics opportunities in a middle eastern country.

Bernard Bouillaud, the Strategy Director for Middle East & Africa at Rockwell Collins, pointed out the agreement, an MoU is a first step to further discuss with Taqnia the scope of avionics to be fitted onboard platforms locally upgraded or manufactured. “This could include MRO,” the industry veteran added.

Bouillaud reported on 4 January that initial details of this collaborative effort were slowly emerging. For instance, it is unknown where avionics-related work will occur within KSA. Asked which aircraft would be included in avionics work, Bouillaud responded: “Sikorsky BLACKHAWK S-70i and Antonov-132 will be discussed, as Taqnia is already discussing with these two OEMs.”

Bouillaud concluded the next step in the initial collaborative venture is to set up joint working groups between Taqnia and Rockwell Collins, “to assess potential local content, Saudi market trends,” and resolve other components of a business plan.

More Innovation on the Way

The military-industry team is gaining returns on investments by inserting innovation into MRO processes. Global networks, cutting edge technologies and partnerships, are among the strategies allowing the MRO enterprise to return weapons platforms and other materiel, to service faster and cheaper. As most nations will have constrained defence resources for the foreseeable future, senior military officials and managers will look to achieve additional life cycle cost reductions by gaining more efficiencies from their MRO programmes by expanding the innovation envelope.

Marty Kauchak